For the Personal Internet & Identity Coverage Master Policy

This summary is provided to inform you that as a customer of Bossmaker Debt Relief, you are entitled to benefits under the Master Policy referenced below. Please note that this summary does not cover all the terms, conditions, and exclusions of the policy. Your benefits will be subject to all the terms, conditions, and exclusions of the Master Policy, even if they are not specifically mentioned here. A complete copy of the policy can be provided upon request.

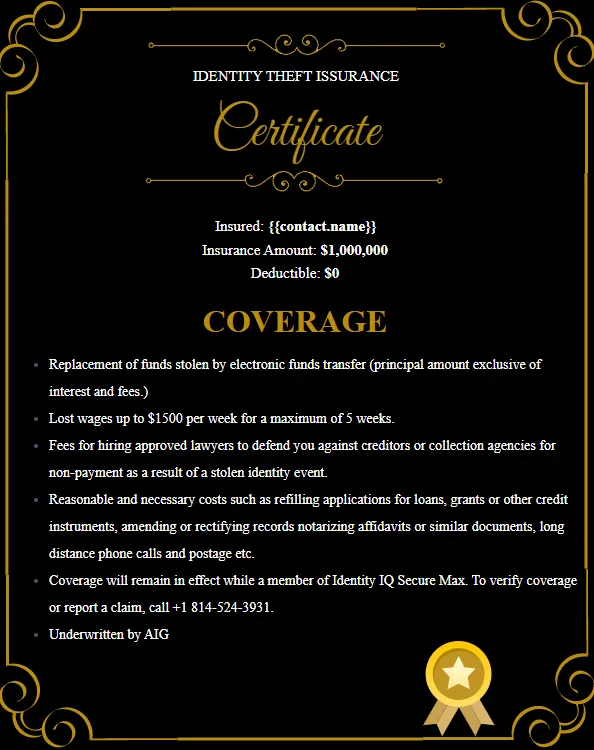

The Master Policies of Personal Internet Identity Coverage have been issued to Bossmaker Debt Relief (the “Master Policy Holder”), under Policy Numbers: [29107020 and 29107025], respectively underwritten by insurance subsidiaries or affiliates of American International Group, Inc., to provide benefits as described in this summary.

* Identity protection is underwritten by AIG. Terms and conditions apply. *

General Information

Should you have any questions regarding the Membership Program provided by the Master Policyholder or wish to view a complete copy of the Master Policy, please call our customer service number located in your membership materials.

Limits of Insurance

Aggregate Limit of Insurance: $1,000,000 per policy period

Lost Wages: $1,500 per week, for a maximum of 5 weeks

Travel Expenses: $2,000 per policy period

Elder Care and Child Care: $2,000 per policy period

Initial Legal Consultation: $1,000 per policy period

Deductible: $0 per policy period

Filing a Claim

If you have any questions regarding identity theft insurance coverage or wish to file a claim under the Master Policy, please contact the Insurer at 1-866-IDHelp2 (1-866-434-3572).

Benefits

We shall provide coverage for the following in the event of a Stolen Identity Event:

Costs Covered

Reasonable and necessary costs incurred in the U.S. to re-file applications for loans, grants, or credit instruments rejected due to a stolen identity event.

Costs for notarizing affidavits, long-distance calls, and postage solely for reporting or rectifying records due to a stolen identity event.

Up to six credit reports (no more than two from each bureau) dated within 12 months of discovering the stolen identity event.

Approved costs for credit monitoring services or public database inquiries resulting from the stolen identity event.

Travel expenses within the U.S. for the purpose of rectifying records due to the stolen identity event.

Costs for elder or child care incurred while resolving identity theft-related issues.

Lost Wages

Actual lost wages incurred for time taken off from work to rectify records related to a stolen identity event, up to a maximum of 12 months after discovery. Lost wages include remuneration for vacation days, floating holidays, and paid personal days. Self-employed professionals must support claims with prior-year tax returns.

Legal Defense Fees and Expenses

Reasonable and necessary legal defense fees for:

Initial consultations with a lawyer to assess the response to a stolen identity event.

Defending civil suits or collection claims related to non-payment or default due to identity theft.

Removing civil judgments wrongfully entered against you due to identity theft.

Defending criminal charges related to a stolen identity event, provided you are proven not to be the perpetrator.

Unauthorized Electronic Fund Transfer Reimbursement

Reimbursement for the principal amount (exclusive of interest and fees) incurred due to an unauthorized electronic fund transfer from your personal deposit account, provided it occurred within the policy period and you sought reimbursement from the issuing financial institution.

Definitions

Stolen Identity Event: Fraudulent use of your name, Social Security number, bank account, credit card information, or any personally identifiable information to open credit accounts, secure loans, commit crimes, or engage in medical identity theft.

Unauthorized Electronic Fund Transfer (UEFT): A transfer from your account initiated without your authorization, provided you received no benefit from the transfer. Does not cover transfers initiated by those furnished with the access device unless previously reported as unauthorized.

Coverage Scope

Stolen Identity Event: Coverage is provided only if you report the event within 90 days of discovery and follow the instructions provided in your claims kit.

Unauthorized Electronic Fund Transfer: Coverage applies only if reported within 90 days of discovery, provided the transfer occurred while you were an active member of the Membership Program.

Limits of Insurance

All legal costs will be part of and subject to the aggregate limit of $1,000,000.

The lost wages, travel expenses, initial legal consultation, and elder/child care are sublimits of the aggregate limit.

Deductible

You are responsible for only one deductible per policy period, which is $0 in this case.

Other Insurance

This policy is excess over any other applicable insurance (e.g., homeowners or renters insurance). If another insurance policy applies, it will pay first, and this policy will cover the remaining amount, up to its limits.

Duplicate Coverage

If you are enrolled in more than one membership program insured by us, the total reimbursement will not exceed the actual amount of the loss, subject to applicable deductibles and limits.

Get In Touch

Email Us: [email protected]

Call Us: (800) 987-0288

Address: 607 Shelby St Ste 700-1163 Detroit MI. 48226

Follow Us

Copyright © 2024 Bossmaker. All Rights Reserved